Awe-Inspiring Examples Of Tips About How To Find Out When You Will Get Your Tax Return

We’ll calculate the difference on what you owe and what you’ve paid.

How to find out when you will get your tax return. Online returns process in 2 weeks (14 days) while paper takes up to 10 weeks (50. See your tax refund estimate. If you file electronically and opt to receive your refund via direct deposit, you can expect your tax refund to arrive within 21 days of submitting your return.

Using the irs where’s my refund tool viewing your irs account. Check your refund status by phone before you call. The irs will send your transcript within 10 days of receiving your request.

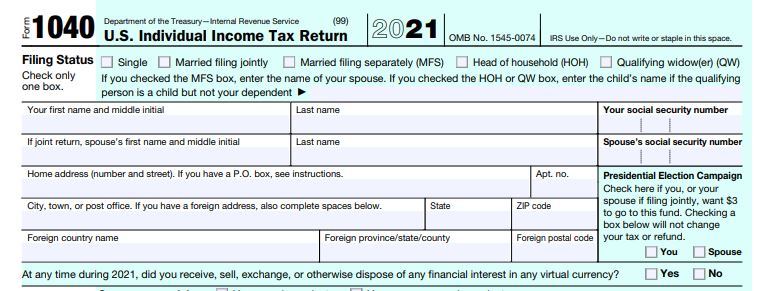

For turbotax live full service, your tax expert will amend your 2021 tax return for you through 11/30/2022. The irs began accepting and processing federal tax returns on january 24, 2022. Request a copy of a tax return from the irs.

Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Taxpayers can complete and mail form 4506 to request a copy of a tax return and mail the request to the appropriate irs office listed on the form. Prepare and file your federal income taxes online for free.

Full name and date of birth; Charlie baker originally proposed a $250 refund, intended for individual filers who earned between $38,000 and $100,000 last year and joint filers who made up to $150,000. If you’ve already paid more than what you will owe in taxes, you’ll likely receive a refund.

Check for the latest updates and resources throughout the tax season Taxpayers can start checking their refund status within 24 hours after. Find out how to correct or fix a.