Neat Info About How To Apply For A Utr Number

Register for self assessment ;

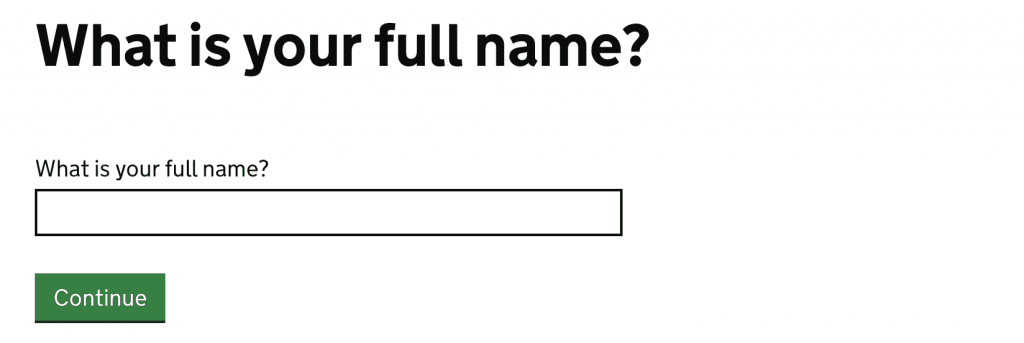

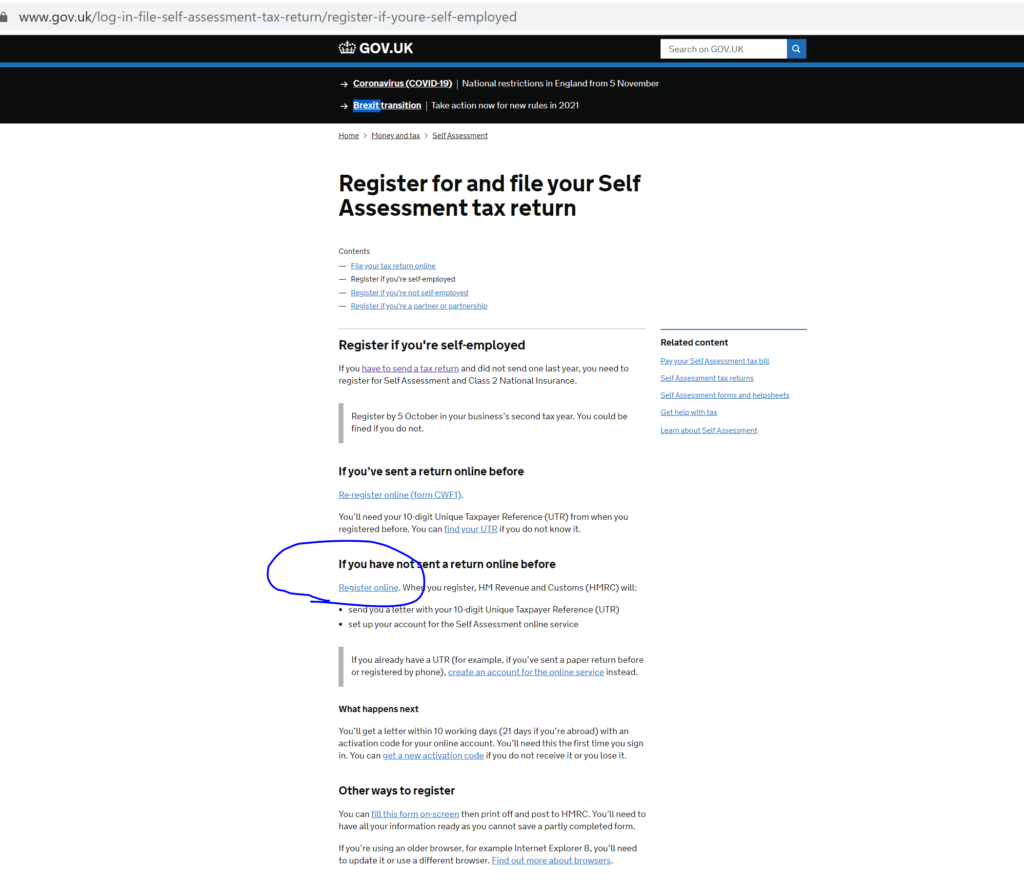

How to apply for a utr number. Register for self assessment by filling in the relevant form according to your employment status. You might need to register in a different way if: Follow these steps to retrieve your utr number:

Registering for a utr number is pretty easy, actually. If you have a limited company, you can request your corporation tax utr online. Before you go ahead and get started, make sure you have all the right information to hand.

If you’re setting up a limited company, the company will be allocated a. As soon as you register for. This can be done on hmrc’s website.

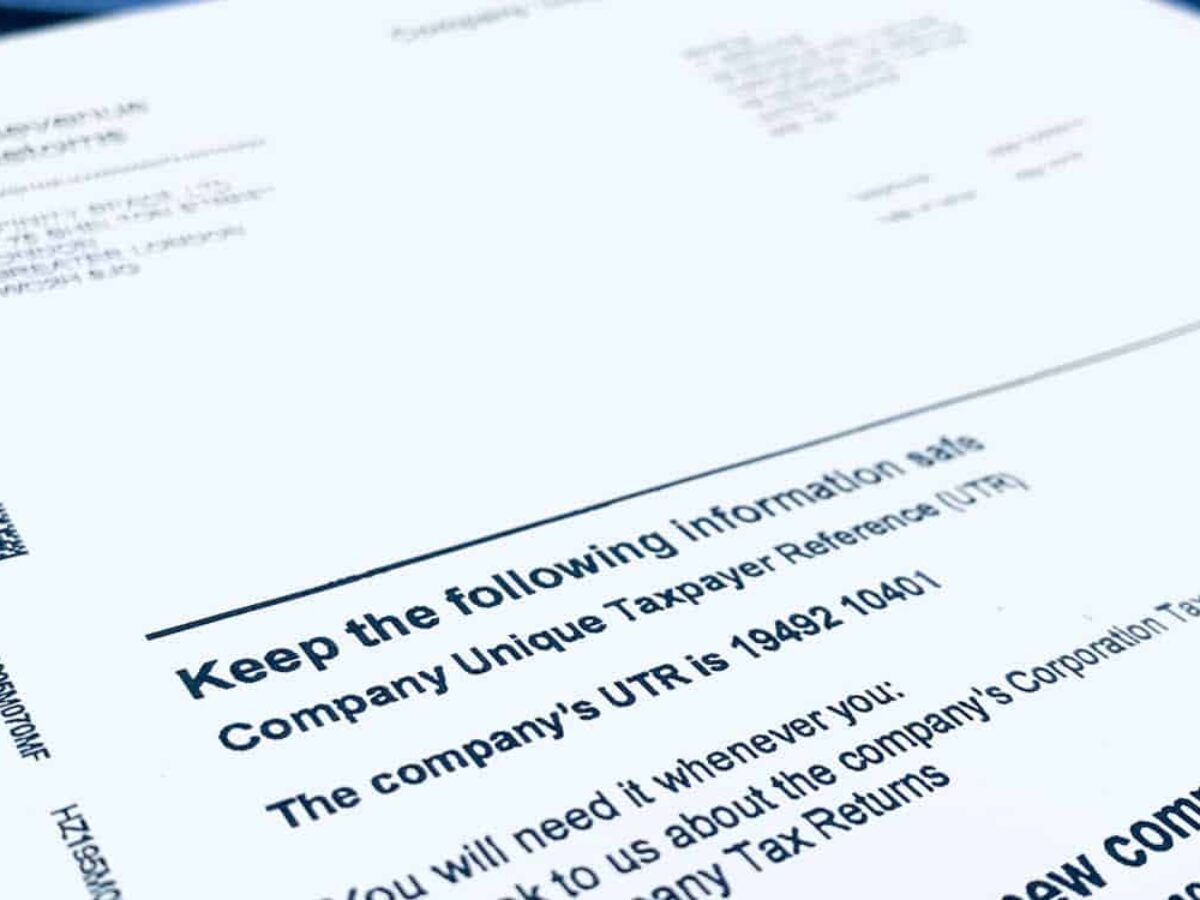

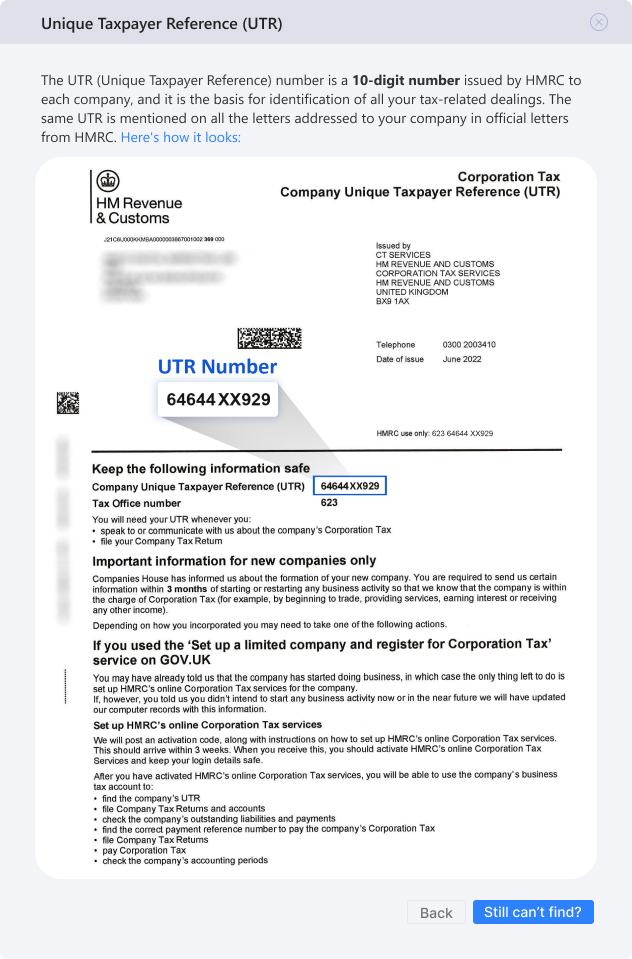

After you’ve registered, you’ll receive your unique taxpayer reference ( utr) number in the post within 10 working days. If you have not yet got your utr number, it is a simple process to apply for one. A utr (unique taxpayer reference) number or tax reference is a 10 digit code that is allocated to you as a freelancer.

You can apply for your utr number by calling hmrc directly on 0300 200 3310. You work in construction ; Apply for a national insurance number if you do not have one ;

Register for self assessment ; Name, dob and your personal. Apply for a national insurance number if you do not have one ;

![9 Things You Need To Know About Utr Numbers [2022]](https://global-uploads.webflow.com/5d71eeb2a19ee03e3430f50f/618bbbd6e4373f581237eee7_UTR%20Number%20v2.png)